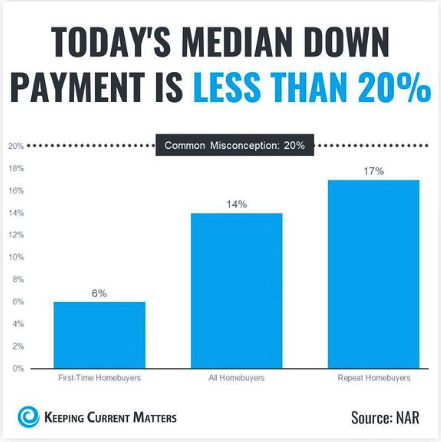

Many buyers feel they need to put 20% down to buy a home.

In reality, the typical buyer doesn't do it.

Among buyers taking out a loan (i.e. excluding cash buyers), the average down payment looks like:

- First-time buyers: 6%

- Repeat buyers: 17%

- Total (both groups above): 14%

Some Conventional loan programs allow as low as 3% down; many others start at 5%.

FHA allows 3.5% down.

VA allows 0% down.

As you can see, there are plenty of options. The biggest two advantages to putting 20% down:

- Better loan terms

- Pay no mortgage insurance

Of course, the more you put down, the less you pay on the debt each month, but that's true at all down payment levels. 20% is a common threshold for better terms. Oddly, however, there are some occasions where I've seen buyers get better terms at 15% down, though that's not the norm.

Reach out if you have any questions or would like to be introduced to a great Loan Officer/Mortgage Broker.